binaryoptionstradingusa.site Prices

Prices

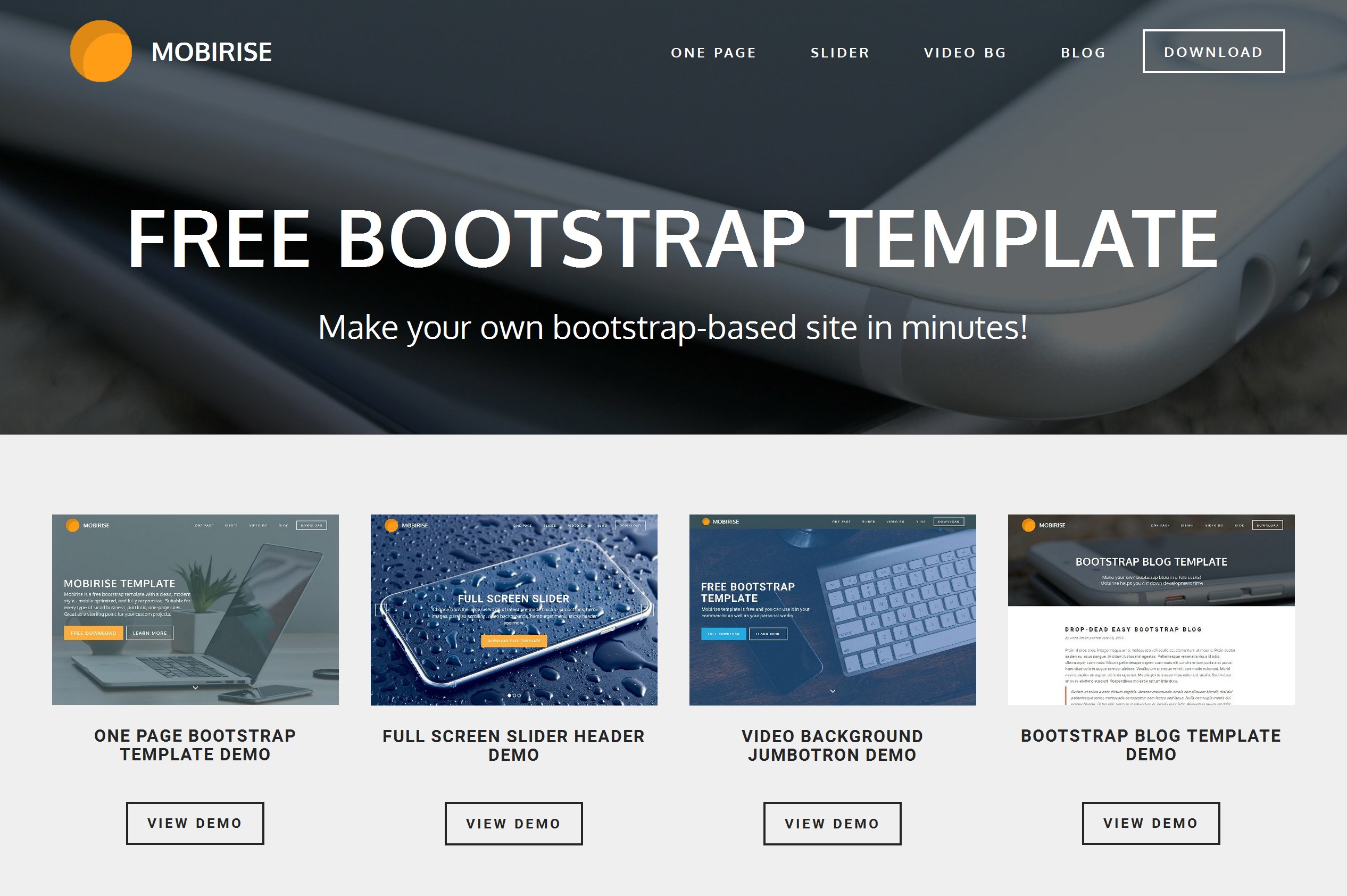

How To Create A Website With Bootstrap

Get started by including Bootstrap's production-ready CSS and JavaScript via CDN without the need for any build steps. See it in practice with this Bootstrap. To create your site, just hit the Create button and it will show up in your list of sites. You can edit and delete the site from a menu that is triggered by. Download Bootstrap: Go to the Bootstrap website and download the latest version of the framework. · Create a new HTML file: Create a new file. What you'll learn · Will develop the front end of responsive websites with animations. · Using HTML and CSS Professionally to Advance level in Developing. With these two languages, you will have the skills you need to bring your website design to life. Jumpstart that vision by using Bootstrap, a popular library. High quality HTML website templates created with the Bootstrap framework. Website templates are quick and easy solution that can help you to launch a. Objective 1: Create the basic site layout · Step 1a: Set up the HTML file · Step 1b: Use Bootstrap to plan layout. Get started by including Bootstrap's production-ready CSS and JavaScript via CDN without the need for any build steps. See it in practice with this Bootstrap. Bootstrap Studio is a powerful desktop app for designing and prototyping websites. It comes with a large number of built-in components, which you can drag. Get started by including Bootstrap's production-ready CSS and JavaScript via CDN without the need for any build steps. See it in practice with this Bootstrap. To create your site, just hit the Create button and it will show up in your list of sites. You can edit and delete the site from a menu that is triggered by. Download Bootstrap: Go to the Bootstrap website and download the latest version of the framework. · Create a new HTML file: Create a new file. What you'll learn · Will develop the front end of responsive websites with animations. · Using HTML and CSS Professionally to Advance level in Developing. With these two languages, you will have the skills you need to bring your website design to life. Jumpstart that vision by using Bootstrap, a popular library. High quality HTML website templates created with the Bootstrap framework. Website templates are quick and easy solution that can help you to launch a. Objective 1: Create the basic site layout · Step 1a: Set up the HTML file · Step 1b: Use Bootstrap to plan layout. Get started by including Bootstrap's production-ready CSS and JavaScript via CDN without the need for any build steps. See it in practice with this Bootstrap. Bootstrap Studio is a powerful desktop app for designing and prototyping websites. It comes with a large number of built-in components, which you can drag.

How to use Bootstrap to create a responsive website · HTML-Used to define the content of the website that you are designing. · CSS -Used to. Bootstrap gives you the ability to build modern fully responsive websites quickly. Best of all Bootstrap is a free and open-source front-end web framework. Its. Learn how to create responsive website design or layout easily with the Bootstrap framework to target wide range of devices like desktops, tablets. In this chapter, we will create an e-commerce website that will help you get to grips with web designing using Bootstrap. Initially, we will build the parts. Yes, Bootstrap is a popular framework for creating websites. It offers a collection of HTML, CSS, and JavaScript tools for building responsive. Bootstrap websites · Bootstrap website with the title 'cloco Website Design' · Bootstrap website with the title 'IronPDF' · Bootstrap website with the title '. Websites using Bootstrap. Best examples of websites made with Bootstrap. Step 1: Creating new design · Step 2: Exploring bootstrap studio · Step 3: Download components online · Step 4: Drag and drop ui components. Build around the jumbotron with a navbar and some basic grid columns. Navbars. Taking the default navbar component and showing how it can be moved, placed, and. Bootstrap is an open-source, free web development framework. It is designed to ease the web development process as it helps web developers build websites faster. Build fast, responsive sites with Bootstrap · Get started any way you want · Customize everything with Sass · Build and extend in real-time with CSS variables. Step 2: Design the Landing Page · Include a navigation bar and custom CSS · Create a page content container · Add a background image, custom JavaScript and an. Bootstrap is a free front-end framework for faster and easier web development · Bootstrap includes HTML and CSS based design templates for typography, forms. Hi everyone, I'm a front-end developer and I built an online library of HTML blocks using Bootstrap + a copy-paste tool to copy any block's. Task. In JSFiddle or another IDE, create a webpage that uses the Bootstrap library. Place some dummy content in your web page, and modify the HTML to show the. Bootstrap is a free front-end framework for faster and easier web development · Bootstrap includes HTML and CSS based design templates for typography, forms. Creating a Bootstrap Website with binaryoptionstradingusa.site Bootstrap is one of the most popular frameworks for rapidly building seamless, mobile-friendly websites with. Agencies: Branding your Back-End · 1. Elite Admin – Multipurpose Bootstrap 4 Admin Template by MARUTI · 2. Fuse – Angular5+ & AngularJS & Bootstrap 4 HTML. Initiate your project by creating a new directory for your website and establishing your HTML, CSS, and JavaScript files. Bootstrap can be. To get started, we need to set up a new web project with Bootstrap 4 included. The simplest way is to use a CDN (content delivery network) to load Bootstrap's.

Can I File Taxes For My Deceased Father

The return is due by the filing deadline for the tax year in which the taxpayer died. You may file an extension by April 15 (or the date indicated for the. person appointed by the court to handle the estate · Surviving spouse · Immediate blood relative (children, parents, siblings) · Other blood relative . Even if he did have a filing requirement you wouldn't necessarily have to file the return unless you are an executor or personal representative. If the income earned by the decedent, up until the date of death, meets the minimum filing requirements, it must be reported. The final tax return should be. In general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Use Form to claim a refund on behalf of a deceased taxpayer. Who Must File. If you are claiming a refund on behalf of a deceased tax- payer, you may. In that circumstance, you should file any missing individual income tax returns on their behalf. The return can be completed by a surviving spouse or legal. A tax return for a decedent can be electronically filed. · A personal representative may also obtain an income tax filing extension on behalf of a decedent. Any refund will be made payable to you. If you're the court-appointed or certified personal representative (executor or administrator) filing for a deceased. The return is due by the filing deadline for the tax year in which the taxpayer died. You may file an extension by April 15 (or the date indicated for the. person appointed by the court to handle the estate · Surviving spouse · Immediate blood relative (children, parents, siblings) · Other blood relative . Even if he did have a filing requirement you wouldn't necessarily have to file the return unless you are an executor or personal representative. If the income earned by the decedent, up until the date of death, meets the minimum filing requirements, it must be reported. The final tax return should be. In general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Use Form to claim a refund on behalf of a deceased taxpayer. Who Must File. If you are claiming a refund on behalf of a deceased tax- payer, you may. In that circumstance, you should file any missing individual income tax returns on their behalf. The return can be completed by a surviving spouse or legal. A tax return for a decedent can be electronically filed. · A personal representative may also obtain an income tax filing extension on behalf of a decedent. Any refund will be made payable to you. If you're the court-appointed or certified personal representative (executor or administrator) filing for a deceased.

You can file taxes for a deceased parent or any relative using the same methods required for any taxpayer. Report all income earned until the day of death and. A return must be filed for a deceased person who would have been required to file an income tax return. If the inheritance tax is paid within nine months of date of decedent's death, a 5 percent discount is allowed. The tax due should be paid when the return is. But understanding your loved one's tax filing is important because the IRS can pursue you to pay their taxes if you are the spouse of the deceased or next of. If the deceased had not filed individual income tax returns for the years prior to the year of their death, you may have to file. It's your. Yes, it can. If paper-filed, write “Deceased,” the taxpayer's name, and the taxpayer's date of death across the top of the final return. If e. Once the CRA has updated your account, you will have the ability to manage tax matters for the deceased person, or appoint a third-party representative, such as. If the deceased person didn't have any reportable income or assets to claim in their estate, you do not need to file an estate tax return on their behalf using. You do not need to file Form N to claim the refund on Mr. Green's tax Your father died on August You are his sole survivor. Your father did. The Affidavit of Exemption should ease the administration of estates that do not owe any Kentucky death tax and are not required to file a Federal Estate and. When someone is deceased, the decedent's personal representative is generally required to file any final tax returns for the deceased person. This includes. It's the executor's job to file a deceased person's state and federal income tax returns for the year of death. If a taxpayer died before filing a return for , the taxpayer's spouse or personal representative may have to file and sign a return for that taxpayer. This is a tax on the value of the net assets owned at the date of death. This tax can get as high as 40%. If this person has made substantial gifts during his. print the name of the taxpayer on the appropriate line; · write "deceased" and the date of death above the decedent's name; and · write "in care of," and the. If an individual died during the tax year, the executor, administrator, or the surviving spouse must file an Indiana income tax return. The surviving spouse, administrator, or executor may file a return on behalf of a taxpayer who died during the taxable year. When filing, use the same. Before You Begin: If you are a surviving spouse filing a joint return with the deceased person, do not file Form N. his father's final income tax return. This form is typically filed by a surviving spouse, another beneficiary, or the executor of the deceased's estate. If there is no will, though, the probate. You may e-file or paper file a Claim for Refund Due a Deceased Taxpayer MI When supported by the software provider, a death certificate or Letters of.

1 2 3 4 5