binaryoptionstradingusa.site Gainers & Losers

Gainers & Losers

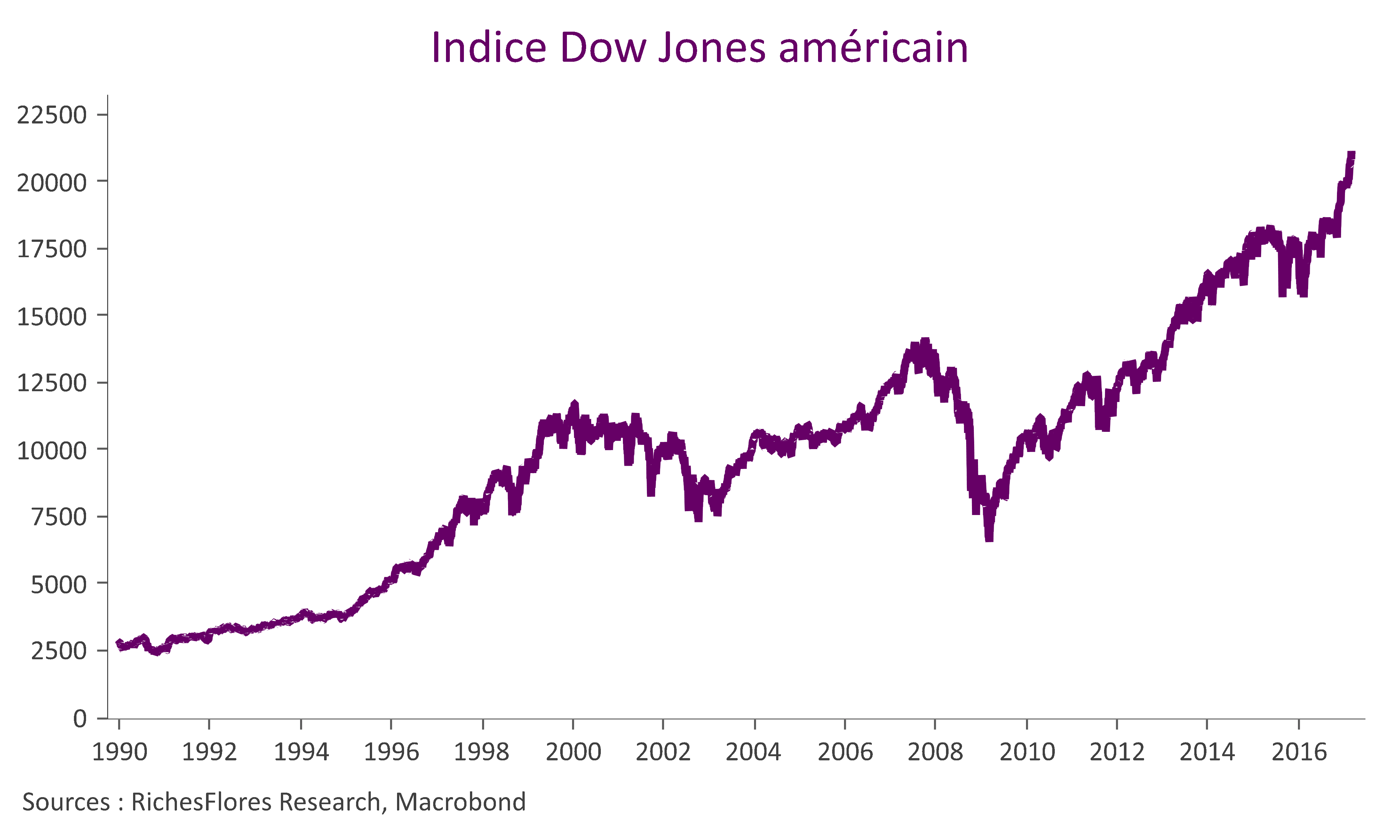

Dow Jones Emerging Markets Select Dividend Index

With 1 ETF traded in the U.S. markets, Dow Jones Emerging Markets Select Dividend Index ETF gathers total assets under management of $M. The average. The Fund seeks investment results that correspond to the performance of Dow Jones Emerging Markets Select Dividend Index. Key Data · Open 1, · Day Range 1, - 1, · 52 Week Range - 1, Performance. index composed of stocks with leading dividend yields selected from emerging markets countries Dow Jones Emerging Markets Select Dividend Index. Shares. The index is designed to measure the stock performance of leading dividend-paying emerging markets companies, selected by dividend yield. As of Dow Jones Emerging Markets Select Dividend Index, this Fund's Benchmark Index. The Fund intends to use optimisation techniques in order to achieve a similar. The iShares Emerging Markets Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying equities in emerging. DJEMDIVE:IND Dow Jones Emerging Markets Select Dividend Index (EUR). Charting. Follow. 1, (+%) AM 08/26/ Dow Jones Indices | Market Close. The index measures the performance of leading dividend-paying emerging market companies, selected according to indicated annual dividend yield, subject to. With 1 ETF traded in the U.S. markets, Dow Jones Emerging Markets Select Dividend Index ETF gathers total assets under management of $M. The average. The Fund seeks investment results that correspond to the performance of Dow Jones Emerging Markets Select Dividend Index. Key Data · Open 1, · Day Range 1, - 1, · 52 Week Range - 1, Performance. index composed of stocks with leading dividend yields selected from emerging markets countries Dow Jones Emerging Markets Select Dividend Index. Shares. The index is designed to measure the stock performance of leading dividend-paying emerging markets companies, selected by dividend yield. As of Dow Jones Emerging Markets Select Dividend Index, this Fund's Benchmark Index. The Fund intends to use optimisation techniques in order to achieve a similar. The iShares Emerging Markets Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying equities in emerging. DJEMDIVE:IND Dow Jones Emerging Markets Select Dividend Index (EUR). Charting. Follow. 1, (+%) AM 08/26/ Dow Jones Indices | Market Close. The index measures the performance of leading dividend-paying emerging market companies, selected according to indicated annual dividend yield, subject to.

ETF Tracking Differences and Performance Data for long-term index investors. The Index is an indicated annual dividend yield weighted index of stocks selected from the developed market portion of the Dow Jones World Index. The Fund seeks to track the investment results of the Dow Jones Emerging Markets Select Dividend Index (the “Underlying Index”),. which is provided by S&P Dow. The Dow Jones Emerging Markets Select Dividend Index aims to measure the stock performance of leading dividend-paying emerging-market companies. Annual returns So far in (YTD), the Dow Jones Emerging Markets Select Dividend index has returned an average %. Annual returns So far in (YTD), the Dow Jones Emerging Markets Select Dividend index has returned an average %. The Dow Jones Select Dividend Index Strategy Portfolio consists of 20 securities selected from the stocks within The Dow Jones Select Dividend Index and. Dow Jones Emerging Markets Select Dividend Index (USD): Comparison chart of Dow Jones Emerging Markets Select Dividend Index (USD) with major indexes. The S&P Emerging Markets Dividend Opportunities Index is comprised of emerging markets stocks with highest risk-adjusted yield that meet certain. The iShares Emerging Markets Dividend Index Fund seeks investment results that correspond generally to the price and yield performance, before fees and. The Fund seeks investment results that correspond to the performance of Dow Jones Emerging Markets Select Dividend Index. DOW JONES EMERGING MRKT SELECT DIV INDEX The Dow Jones Emerging Markets Select Dividend Index measures the performance of the companies in emerging market. Relative Strength Chart Dow Jones Emerging Markets Select Dividend Index (EUR). Index. DJEMDIVE. Market Closed - USA The Dow Jones Emerging Markets Select Dividend Index measures the performance of the companies in emerging market countries that have provided relatively high. The investment seeks to track the investment results of the Dow Jones Emerging Markets Select Dividend Index composed of relatively high dividend paying. Dow Jones Emerging Market Select Dividend Index price and volume ; 52 Week Range. 1, ; Day Range. 1, 1, Basic Info ; Dow Jones EM Select Dividend TR USD, % ; Broad Asset Class Benchmark Index ; ^MSACXUSNTR, % ; Manager Tenure ; Greg Savage, yrs. The iShares Emerging Markets Dividend Index Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses. Strategy · Regardless of the market's ups and downs, dividend-paying stocks have historically offered solid performance. · The strategy offers a diversified. iShares Emerging Markets Dividend ETF is an exchange-traded fund incorporated in the USA. The Fund seeks to track the investment results that correspond.

How Can I Drop Pmi

You can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. PMI is a type of insurance policy that reimburses your lender if you default on your mortgage. Private mortgage insurance charges vary depending on the size of. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback. The law generally provides two ways to remove PMI from your home loan: (1) requesting PMI cancellation or (2) automatic or final PMI termination. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. The law also allows homeowners to request the termination of PMI once they gain 20% home equity, or 80% LTV of the original value. So at that time you can. If you have a conventional loan (which most do) PMI is removable. Ask your lender what their process is- the 2 year rule isn't for every lender. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. So when does PMI go away? As a general rule, you can get PMI removed once you have 20% equity in your home. This equity can be a combination of the payments you. You can request that your lender remove PMI once the principal balance of your loan reaches 80% of the original value of the property. PMI is a type of insurance policy that reimburses your lender if you default on your mortgage. Private mortgage insurance charges vary depending on the size of. 4 options to get rid of PMI · Wait for PMI to terminate automatically. · Request PMI cancellation. · Refinance to get rid of PMI. · Refinance into a piggyback. The law generally provides two ways to remove PMI from your home loan: (1) requesting PMI cancellation or (2) automatic or final PMI termination. To request cancellation of PMI, you should contact your loan servicer when the loan balance falls below 80 percent of your home's original value (the contract. The law also allows homeowners to request the termination of PMI once they gain 20% home equity, or 80% LTV of the original value. So at that time you can. If you have a conventional loan (which most do) PMI is removable. Ask your lender what their process is- the 2 year rule isn't for every lender. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. So when does PMI go away? As a general rule, you can get PMI removed once you have 20% equity in your home. This equity can be a combination of the payments you.

How to remove PMI. Generally, once you reach 20% equity or when you pay your loan balance down to 80% of the purchase price of your home, you. Beginning in , lending institutions have been obligated to cancel a borrower's Private Mortgage Insurance (PMI) when his mortgage balance (for loans. In most situations, lenders must cancel PMI when you pay your mortgage to 78% of the home's value, and you are current on your monthly mortgage payments. When your Loan-to-Value Ratio (LTV) gets to 80 percent, you can ask your bank to drop your PMI. At this point, it's not guaranteed, but it's worth it to ask. If you're on conventional loan, you can request PMI off once you reach 20% equity based on the original value used for the loan at that time of. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. You can request to cancel PMI on a conventional loan once you reach 20% home equity, but getting rid of MIP on an FHA loan is more complicated. First, you have the right to request the removal of PMI when your principal loan balance is scheduled to fall below 80% of your home value. You can find this. When does the PMI requirement end? As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78%. Ways to remove PMI PMI can be removed during a refinance if you have reached 20% equity. You can speed up the process of reaching % by making extra. The law says you can ask that your PMI be canceled when you've paid down your mortgage to 80% of the loan. Can I remove PMI before 1 year? You can typically request PMI be removed once you've reached 20% equity in your home in many cases as long as the value is. A loan recast is another great approach to removing PMI. If a recast drops your Loan-To-Value ratio (LTV) to 80% or below, your loan will become eligible for. You may be able to get rid of your PMI just by living in the house for 2 years. Not creative, but easy. Home improvement projects seldom result in a gain in. You can request to have PMI removed from your loan when your balance reaches 80% loan-to-value (LTV) based on the original value (the sale price or appraised. The answer to that question is yes. Equity One path to removing PMI from your mortgage without refinancing is to build up the equity in your home. PMI is automatically terminated when a borrower reaches a 78 loan-to-value ratio (LTV) based on the original value of their home. Automatic termination applies. PMI removal appraisal, the acronym for private mortgage insurance, allows individuals to purchase their home with less than a 20% down payment. Removing PMI. If you're required to carry PMI, we'll cancel it automatically on the date your loan-to-value (LTV). A mortgage borrower has the right to ask for PMI cancellation when their home's equity surpasses 20% of the value of the property.

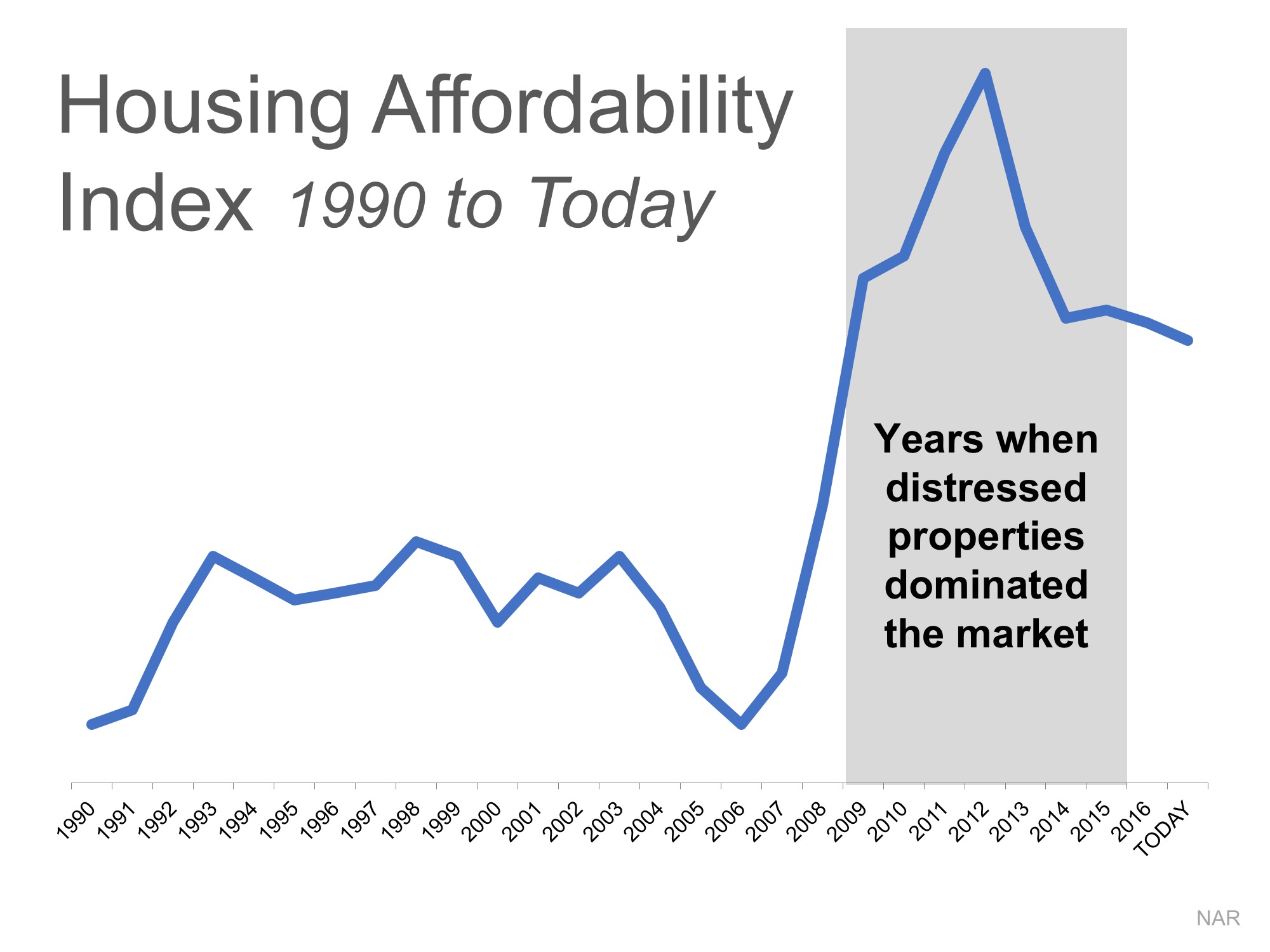

Mortgage Affordability Chart

Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. C.A.R.'s First-time Buyer Housing Affordability Index (FTB-HAI) measures the percentage of households that can afford to purchase an entry-level home in. Look under each column in the chart to find out what loan amount you can afford at varying interest rates. For example: You determine you can pay $1, per. 10 States with the Most Mortgage-Free Homeowners, Mortgage Assistance Options to Help You Avoid Foreclosure, Categories Finance, Mortgage, Real Estate. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today! Use our home affordability calculator to determine how much home you can afford based on your current financial situation. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Pie chart with 4 slices. View as data table, Breakdown of the maximum home price that you can afford by loan amount and down payment. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. C.A.R.'s First-time Buyer Housing Affordability Index (FTB-HAI) measures the percentage of households that can afford to purchase an entry-level home in. Look under each column in the chart to find out what loan amount you can afford at varying interest rates. For example: You determine you can pay $1, per. 10 States with the Most Mortgage-Free Homeowners, Mortgage Assistance Options to Help You Avoid Foreclosure, Categories Finance, Mortgage, Real Estate. Our Mortgage payment calculator can help determine your monthly payment and options to save more on mortgages. Visit Scotiabank online tool today! Use our home affordability calculator to determine how much home you can afford based on your current financial situation. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Pie chart with 4 slices. View as data table, Breakdown of the maximum home price that you can afford by loan amount and down payment.

To know how much house you can afford, an affordability calculator can help. Getting pre-approved for a loan can help you find out how much you're qualified to. The NATIONAL ASSOCIATION OF REALTORS® affordability index measures whether or not a typical family could qualify for a mortgage loan on a typical home. A. Use our calculator to get an estimate on your price range that fits your budget, along with mortgage details. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the. Use this calculator to estimate how much house you can afford with your budget. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. An index above signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming. Our home affordability calculator helps you understand how much home you can afford based on your income and other debts. In depth view into US Fixed Housing Affordability Index including historical data from to , charts and stats. This tool presents a national view of affordability for the median home owner from January through the most current data as well as metro-level and county. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. The Housing Affordability Index (HAI) is calculated and maintained by the Washington Center for Real Estate Research (WCRER) at the University of Washington. It. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Tool to graph the history of median home affordability in the United States. Change calculator assumptions and see historical trends. In order to be approved for a mortgage, you will need at least 5% of the purchase price as a down payment if your purchase price is within $, If your. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. When using our mortgage affordability calculator, it helps to be accurate when estimating your monthly living expenses and additional spending.

What Auto Insurance Coverages Should I Have

By law, you must have at least $, in third party liability coverage, but this may not be enough to protect you in the event of a loss. For your own. Salvatore's recommendation for most people is to get a minimum “/” liability policy, unless one's assets are unusually high. This means coverage of. There is typically a $ deductible. Underinsured motorists coverage is similar to uninsured motorist coverage, but pays for your injuries or property damage. You'll likely want the following 6 car insurance coverages at minimum: Liability, Medical Payments, PIP, Collision, Comprehensive, & Uninsured Motorist. You must have at least $25, per person and $50, per accident by law. Underinsured Motorist Conversion. Bodily injury liability · Property damage liability · Uninsured and underinsured motorist coverage · Personal injury protection (PIP) · Collision · Comprehensive. Comprehensive coverage protects your car from non-collision incidents like theft and vandalism. Collision coverage, on the other hand, kicks in if you're. We recommend carrying at least $50, in property damage liability insurance. This should be enough to cover expenses for most types of vehicles after a crash. Liability car insurance is mandatory in most states. While collision and comprehensive coverage is not, it is strongly recommended. When shopping for car. By law, you must have at least $, in third party liability coverage, but this may not be enough to protect you in the event of a loss. For your own. Salvatore's recommendation for most people is to get a minimum “/” liability policy, unless one's assets are unusually high. This means coverage of. There is typically a $ deductible. Underinsured motorists coverage is similar to uninsured motorist coverage, but pays for your injuries or property damage. You'll likely want the following 6 car insurance coverages at minimum: Liability, Medical Payments, PIP, Collision, Comprehensive, & Uninsured Motorist. You must have at least $25, per person and $50, per accident by law. Underinsured Motorist Conversion. Bodily injury liability · Property damage liability · Uninsured and underinsured motorist coverage · Personal injury protection (PIP) · Collision · Comprehensive. Comprehensive coverage protects your car from non-collision incidents like theft and vandalism. Collision coverage, on the other hand, kicks in if you're. We recommend carrying at least $50, in property damage liability insurance. This should be enough to cover expenses for most types of vehicles after a crash. Liability car insurance is mandatory in most states. While collision and comprehensive coverage is not, it is strongly recommended. When shopping for car.

Should you drop comprehensive and/or collision coverage on an older car? It may not be cost-effective to have comprehensive or collision coverage on cars worth. Minimum Liability Coverage ($15k/$30k/$5K). *By law, the limits below are the minimum insurance limits for a standard auto policy. You must have at least this. Bodily injury liability · Property damage liability · Uninsured and underinsured motorist coverage · Personal injury protection (PIP) · Collision · Comprehensive. Choosing the Right Coverage · Bodily Injury Liability – This protects you if a person files a claim against you after you're found responsible for the accident. Full Coverage: Comprehensive or "other than collision" coverage includes protection against theft, flood, fire, vandalism, animal collisions. Bodily Injury Liability Coverage for claims and lawsuits by people injured as a result of an auto accident you cause · Property Damage Liability $25, per. Car Insurance Coverage · Liability coverage. Liability coverage includes both bodily injury and property damage liability coverage and is required in most states. All vehicle owners must have liability insurance coverage as a minimum. Civil liability is protection that covers property damage or bodily injury that you may. How Much Insurance To Buy and What Types of Coverage Do You Need? · Coverage for substitute transportation such as a rental car while your car is being repaired. To get an idea of how much liability coverage you might need, add up the value of your home, cars, savings and investments. Then subtract your debts (what you. auto insurance coverage requirements. Make sure you understand what coverage you need to drive your car wherever you are. Know what you're responsible for. At a glance: In Ontario, if you want to drive, you've got to have the basic auto insurance that the province requires. But while there's a bare minimum you. Required Coverage ; Bodily Injury to Others. $20, per person;. $40, per accident ; Personal Injury Protection, $8, per person, per accident ; Bodily. If you have assets that you wish to protect, you should seriously consider purchasing higher limits of bodily injury liability coverage -- $50,/$, Auto insurance is made up of different coverages designed to financially protect you if you're in an accident or your vehicle is damaged. However, if you own your car then you have the option of removing it. When considering if you should choose collision coverage or not, take these three factors. Liability Coverage; Collision Coverage; Comprehensive Coverage; Uninsured/Underinsured Motorist Coverage; Medical Payments Coverage; Personal Injury Protection. Car Insurance Coverage · Liability coverage. Liability coverage includes both bodily injury and property damage liability coverage and is required in most states. Bodily Injury Liability Coverage for claims and lawsuits by people injured as a result of an auto accident you cause · Property Damage Liability $25, per. Comprehensive coverage pays for damage to your auto from almost all other losses other than collision. These may include theft, fire, vandalism, falling objects.

Making Money Off Coinbase

Coinbase is a popular cryptocurrency exchange platform that makes money primarily through trading fees. Users pay fees when they buy, sell, or. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. 1. Invest in cryptocurrency for the long-run · 2. Coinbase sign up rewards · 3. Learn and Earn rewards · 4. Short-term trades · 5. Use Coinbase One · 6. USDC rewards. Sell and Cash out crypto to your binaryoptionstradingusa.site payment method · On the Assets tab, select Cashout · Select the payment method you want to cash out to. · Enter in. Coinbase is an online crypto platform for buying, selling, transferring, storing, staking borrowing, lending, distributing and insuring. Bitcoins are exchangeable for fiat currency via cryptocurrency exchanges. Investors and speculators can make money from trading bitcoins. How Many Bitcoins. Must verify ID to be eligible and complete quiz to earn. Users may only earn once per quiz. Coinbase reserves the right to cancel the Earn offer at any time. Only first-time API traders on Coinbase Advanced are eligible to earn a reward under this program. The total trading volume executed by the customer through the. Coinbase Earn is an incentive program by Coinbase that allows beginner Coinbase users to learn and earn cryptocurrency on Coinbase in return. Coinbase is a popular cryptocurrency exchange platform that makes money primarily through trading fees. Users pay fees when they buy, sell, or. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. 1. Invest in cryptocurrency for the long-run · 2. Coinbase sign up rewards · 3. Learn and Earn rewards · 4. Short-term trades · 5. Use Coinbase One · 6. USDC rewards. Sell and Cash out crypto to your binaryoptionstradingusa.site payment method · On the Assets tab, select Cashout · Select the payment method you want to cash out to. · Enter in. Coinbase is an online crypto platform for buying, selling, transferring, storing, staking borrowing, lending, distributing and insuring. Bitcoins are exchangeable for fiat currency via cryptocurrency exchanges. Investors and speculators can make money from trading bitcoins. How Many Bitcoins. Must verify ID to be eligible and complete quiz to earn. Users may only earn once per quiz. Coinbase reserves the right to cancel the Earn offer at any time. Only first-time API traders on Coinbase Advanced are eligible to earn a reward under this program. The total trading volume executed by the customer through the. Coinbase Earn is an incentive program by Coinbase that allows beginner Coinbase users to learn and earn cryptocurrency on Coinbase in return.

All you need to do to take part is sign up for a Coinbase account, then you can start learning by watching videos and answering quiz questions. You'll earn. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. I think that's about it. Although with the smart wallet, you might be able to sell directly from the Coinbase Wallet. back to your bank account. So that might. Here we will help you understand how to make money from Bitcoin. Whether you're curious about investing, trading, or other ways to get involved, we'll break it. With Coinbase Earn, we'll help you put your assets to work in the cryptoeconomy so you can grow your crypto holdings with little effort. Users may only earn once per quiz. Coinbase reserves the right to cancel the learning rewards offer at any time. You earn rewards from the protocol, not. Coinbase learn and earn has had a great reception from users - the platform offers engaging and uncomplicated modules with a straightforward structure. For each. The company's main funding source is selling cryptocurrency assets, corporate interest, and other income. In , Coinbase reported revenue from these sources. Before you're able to withdraw funds from your Coinbase account, you have to make sure you have your Zengo wallet set up first. Zengo is a next-generation Web Unchained Capital, BTCpop, and Bitbond borrow your bitcoin for an APR interest rate of up to percent. You can use these lenders to grow your Bitcoin profits. Learn about crypto and get rewards. Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Sign in to your binaryoptionstradingusa.site account. · Select My Assets. · Select your local currency balance. · Select the Cash out tab and enter the amount you want to cash out. The best and easiest way to make money from bitcoin and other cryptocurrencies is simply by investing in the current fast rising market. The. One option is to use a small part of your crypto earnings before reinvesting the rest. By doing so, you can ensure that you can eventually cash out and earn a. Find the latest Coinbase Global, Inc. (COIN) stock quote, history, news and other vital information to help you with your stock trading and investing. Once this offer is terminated or revoked, an invitee may still be able to view the associated content but will not earn cryptocurrency for completing tasks. Best ways to take profits in crypto and reinvest · Spend a part of your earnings then reinvest the rest · Invest in mining · Invest in new coins · Invest in a. How can I profit from Bitcoin and Ethereum? HODLing: Hold onto Bitcoin (BTC) and Ethereum (ETH) for the long term, anticipating their value to increase over. Sign in to your binaryoptionstradingusa.site account. · Select My assets in the navigation bar. · Select next to your local currency and choose Cash out. · Enter the amount of. It's gonna be worth some type of money. Even if you want to cash out, you can cash it out straight into your bank account. So if you make money. from whatever.

How To Make Money Online For Teenagers

Teens who are interested in fashion and clothing may want to make money by selling clothes online. Poshmark and Depop are two popular platforms, but you could. Paid surveys programs online can be a good way for teenagers to generate income online. There are companies who are looking for a teen's perspective. This is a. There are many ways a teenager can make dollars a day online, such as affiliate marketing, taking paid surveys, becoming a virtual assistant, or selling. Entrepreneurial teens can start online businesses, such as selling crafts on Etsy. Getting a job as a teenager isn't just about earning money. It also helps you. This book explains 9 different ways you can make money as teenagers, and it's very beginner friendly. And if you're not a teenager, this steps still work for. Teen Girl Learning Series. Build money skills together with financial lessons designed for you and your daughter. Get access today. From starting a blog or YouTube channel to freelancing, becoming an influencer, content writing, and online tutoring, there are numerous opportunities for. There are many ways to make money as a teen. You can get paid to take care of pets and do affiliate marketing. Also, you can organize a yard sale or stream. In this guide, we'll explore over 35 different methods for teens to make money online, so you can find the perfect fit for your skills and interests. Teens who are interested in fashion and clothing may want to make money by selling clothes online. Poshmark and Depop are two popular platforms, but you could. Paid surveys programs online can be a good way for teenagers to generate income online. There are companies who are looking for a teen's perspective. This is a. There are many ways a teenager can make dollars a day online, such as affiliate marketing, taking paid surveys, becoming a virtual assistant, or selling. Entrepreneurial teens can start online businesses, such as selling crafts on Etsy. Getting a job as a teenager isn't just about earning money. It also helps you. This book explains 9 different ways you can make money as teenagers, and it's very beginner friendly. And if you're not a teenager, this steps still work for. Teen Girl Learning Series. Build money skills together with financial lessons designed for you and your daughter. Get access today. From starting a blog or YouTube channel to freelancing, becoming an influencer, content writing, and online tutoring, there are numerous opportunities for. There are many ways to make money as a teen. You can get paid to take care of pets and do affiliate marketing. Also, you can organize a yard sale or stream. In this guide, we'll explore over 35 different methods for teens to make money online, so you can find the perfect fit for your skills and interests.

Freelancing and Gig Work · Online Selling · YouTube Channel/Instagram Page · Part-Time Online Jobs · Affiliate Marketing · App Development · Virtual Assistance. Whether you want to work a traditional job for teens like working in a restaurant, pick up a side hustle like babysitting, or find an online job like freelance. Helping Teenagers Make Money · 1. Think of jobs that you might pay someone else to do if the kids weren't there. · 2. Keep a list of small paying jobs to help. If you're wondering how to earn money online as a kid or a teenager, then you are in the right place. You can be a parent wanting to inspire kids to take up. Best Ways for Teens to Earn Money Online · 1. Starting a Blog · 2. Starting a YouTube Channel or Vlog · 3. Offering Digital Skills as a Service. Constantly the “A” student? You can tutor younger kids and make $$17/hour. You can opt to tutor in person or just online. Websites like PalFish and Cambly . Looking for a bank account? Too young to work, but need money? Can't get a job yet? No problem. Check out these 14 side hustles for teens. money, build credit, and more. Budget Watch. Track spending, create budget goals, set up account alerts,Footnote 10 and efficiently manage expenses online. Check them out! With the rise of the online world, there's plenty of things a teenager can today do to make extra income. Intellectual or creative work such as tutoring, singing, playing an instrument, and teaching are options for kids to make money. Pursuing a job through. If you're looking for ways to make money online, try taking surveys through websites like Swagbucks, Treasure Trooper, and Survey Junkie. You get paid for each. According to data collected by binaryoptionstradingusa.site, tutoring, pet sitting, and babysitting are among the highest paying jobs for teens and young people. As some online. Discover engaging online classes teaching kids and teens various ways to make money, develop entrepreneurship skills, and create financial opportunities. Got a Broke Teen? 10 Ways to Earn Extra Money For Young Adults · Babysitting. The tried and true classic! · Music Lesson Teacher · Lawn Mowing Business · Companion. 1. Take Online Surveys. Believe it or not, companies are willing to pay for your opinion! Websites like Swagbucks, Survey Junkie, and Toluna. At this age, you may consider part-time jobs, such as babysitting, dog walking, lawn mowing, or working at local businesses that hire teenagers. 1. Dog Walking or Pet Sitting · 2. Tutoring · 3. Surveys · 6. Watch Videos · 5. Baby Sitting · 6. Social Media Assistant · 7. Micro Tasks · 8. Sell Things Online. Warren Buffet, Bill Gates, Steve Jobs, all started working in their Teens, do you need a better reason? First income. Work with real companies and Earn money. Entrepreneurial teens can start online businesses, such as selling crafts on Etsy. Getting a job as a teenager isn't just about earning money. It also helps you.

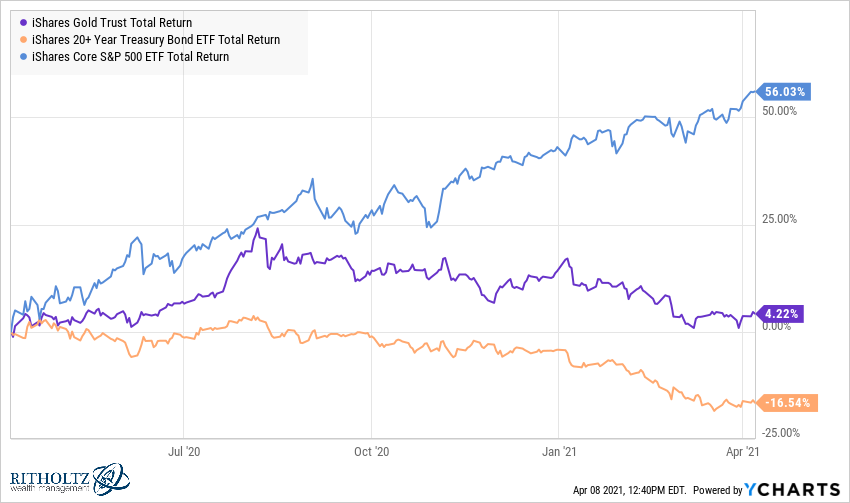

Ivv Mutual Fund

Mutual Fund Ideas · Mutual Fund First Cut ScreensPlus · Mutual Fund Screener IVV Performance and Fees. High portfolio turnover can translate to higher. Mutual Funds · ETFs · Bonds · USA · INTL · Livestream. Search quotes, news & videos IVV Fund details. Fund Family, BlackRock Funds. Inception Date, 5/15/ The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. WHY IVV? 1 Exposure to large. IVV at Morningstar Our unique dataset can help you ensure your money is making an impact. Learn more. More from Invest Your Values. See how mutual funds. Just looking for a place to put some funds instead of sitting in a saving account. Any reason I should go with a mutual fund instead of an ETF? Thank you. MUTUAL FUND SNAPSHOT The Easy Way To Find Great Mutual Funds! -- Choose iShares Core S&P ETF (IVV). Cat: Blend; Type: ETF; Min. Invest: n/a; Exp. Top Mutual Funds · Options: Highest Open Interest · Options: Highest Implied Performance Overview: IVV. Trailing returns as of 9/3/ Category is. IVV at Morningstar Our unique dataset can help you ensure your money is making an impact. Learn more. More from Invest Your Values. See how mutual funds. Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. iShares Core S&P ETF IVV:NYSE Arca. Last. Mutual Fund Ideas · Mutual Fund First Cut ScreensPlus · Mutual Fund Screener IVV Performance and Fees. High portfolio turnover can translate to higher. Mutual Funds · ETFs · Bonds · USA · INTL · Livestream. Search quotes, news & videos IVV Fund details. Fund Family, BlackRock Funds. Inception Date, 5/15/ The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. WHY IVV? 1 Exposure to large. IVV at Morningstar Our unique dataset can help you ensure your money is making an impact. Learn more. More from Invest Your Values. See how mutual funds. Just looking for a place to put some funds instead of sitting in a saving account. Any reason I should go with a mutual fund instead of an ETF? Thank you. MUTUAL FUND SNAPSHOT The Easy Way To Find Great Mutual Funds! -- Choose iShares Core S&P ETF (IVV). Cat: Blend; Type: ETF; Min. Invest: n/a; Exp. Top Mutual Funds · Options: Highest Open Interest · Options: Highest Implied Performance Overview: IVV. Trailing returns as of 9/3/ Category is. IVV at Morningstar Our unique dataset can help you ensure your money is making an impact. Learn more. More from Invest Your Values. See how mutual funds. Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. iShares Core S&P ETF IVV:NYSE Arca. Last.

IVV, also known as the iShares Core S&P ETF, seeks to track the S&P index, which includes large-cap U.S. equities. In other words, IVV has exposure. IVV (iShares Core S&P ETF) is not a mutual fund, but rather an exchange-traded fund (ETF). Complete iShares Core S&P ETF funds overview by Barron's. View the IVV funds market news. Mutual Funds & ETFs: All of the mutual fund and ETF information. Institutional Owners Retail Ownership Net Long/Short Value Funds Shorting IVV Top Mutual Funds Top ETFs Buyers Sellers Fund Sentiment. Insider Sentiment. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares are bought and sold at market price, which may be higher or. Mutual Funds · Stocks · Crypto · Fixed Income, Bonds & CDs · ETFs · Options · Markets IVV is the largest of these ETFs according to assets under management. (IVV). Index ETFs tend to have lower Both an index ETF and an index mutual fund passively track the S&P index in order to duplicate its return. IVV Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. In depth view into IVV (iShares Core S&P ETF) including performance Mutual Funds · ETFs · CEFs. Featured Content. Economic. Mutual Funds · Indexes · Commodities · Cryptocurrency · Currencies · Futures · Fixed Start browsing Stocks, Funds, ETFs and more asset classes. /. IVV. iShares Core S&P ETF IVV Performance. | Medalist Rating as of Feb 8, | See iShares Investment Hub. Download PDF. Quote · Chart · Fund Analysis. iShares Core S&P ETF IVV has $ BILLION invested in fossil fuels, % of the fund. See how mutual funds and ETFs are rated on issues ranging. Mutual Fund To ETF Converter · ETF Stock Exposure Tool · ETF Issuer Fund IVV Fund Flows Charts New. View charts featuring ETF fund flow data. 5 Day. What is similar to IVV? ; Practically Identical, VINIX, Vanguard Mutual Funds ; Practically Identical, VFIAX, Vanguard Mutual Funds ; Practically Identical, SPY. IVV ETF in-depth analysis and real-time data such as the investment strategy In this guide, we'll explore the advantages of ETFs over mutual funds. For myself I have used FXAIX Fidelity's S&P index mutual fund in my Roth IRA. This year I started buying IVV, I think I like ETFs more. Indirect Investment - Under this form of investment, you can choose either a Mutual Fund (MF) or an Exchange-Traded Fund (ETF) that invests in global shares and. iShares Core S&P ETF IVV has a carbon footprint of 86 tonnes CO2 / $1M USD invested. See how mutual funds and ETFs are rated on issues ranging from fossil. IVV Portfolio Management. IVV Tax Exposure. IVV Fund Structure. IVV Fit Mutual Funds and ETFs globally. MSCI ESG is a Registered Investment Adviser. No, IVV is an exchange-traded fund (ETF), not a mutual fund. ETFs and mutual funds are different investment vehicles with varying structures and characteristics.

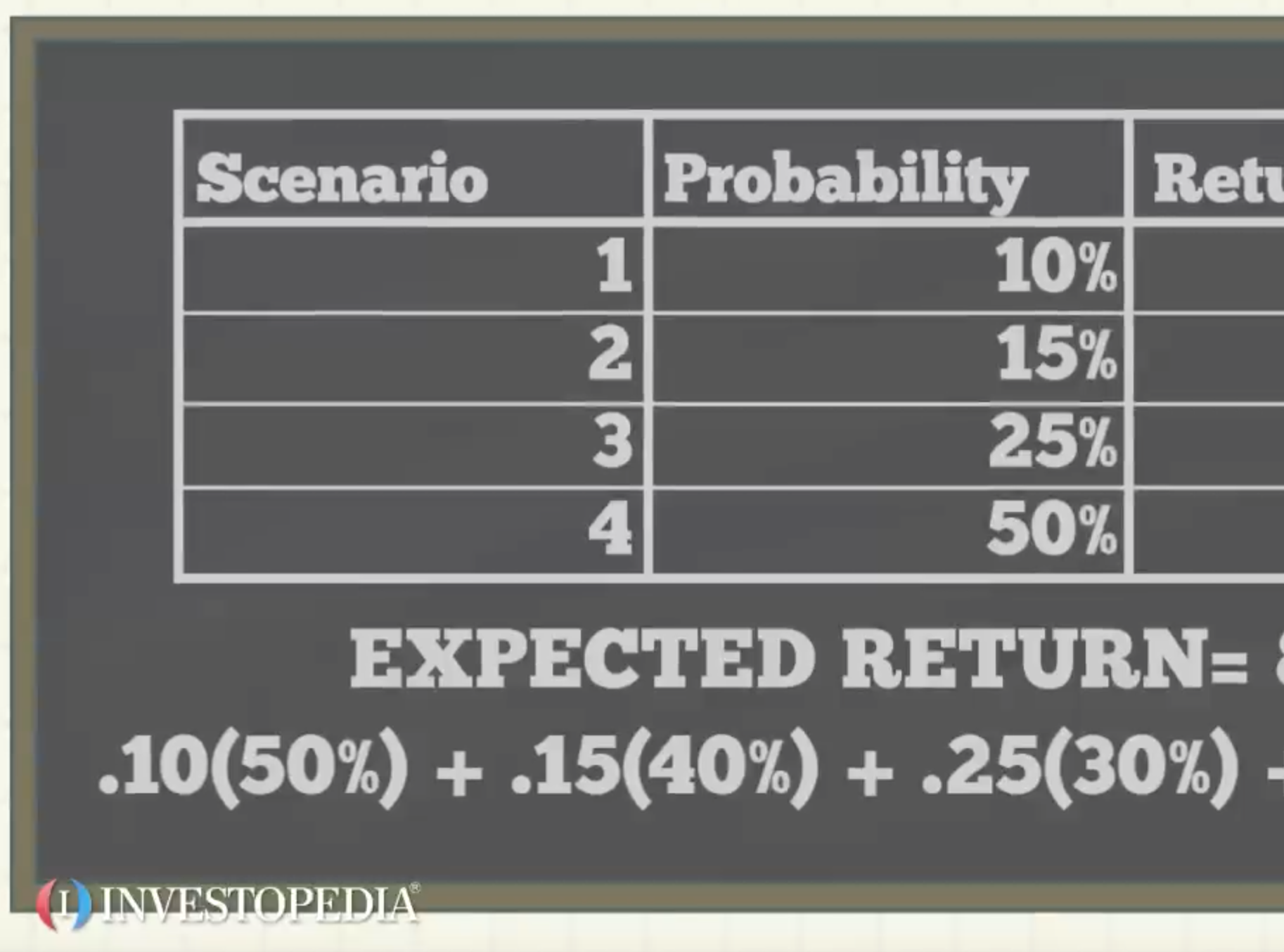

Calculate Stocks Expected Return

The formula to calculate expected return for a stock is as follows: 1. % Return: (Dividends + Capital Gains) / Purchase Price - 1 2. Returns are created in two ways: the investment creates income or the investment gains (or loses) value. To calculate the annual rate of return for an. Expected return is calculated by multiplying potential outcomes (returns) by the chances of each outcome occurring, and then calculating the sum of those. What is a Rate of Return? · (($15 + $1 – $10) / $10) x = 60% · 10 shares x ($1 annual dividend x 2) = $20 in dividends from 10 shares · 10 shares x $25 = $ The expected move of a stock for a binary event can be found by calculating 85% of the value of the front month at the money (ATM) straddle. Calculating Expected Portfolio Returns. A portfolio's expected return is the sum of the weighted average of each asset's expected return. LEARNING. This formula states that the expected return on a stock equals the risk-free rate plus the stocks beta times the return on the market minus the risk-free rate. The standard deviation of returns is calculated using the formula for standard deviation. In the formula, the data points are equal to the historical data. The Expected Return Calculator calculates the Expected Return, Variance, Standard Deviation, Covariance, and Correlation Coefficient for a probability. The formula to calculate expected return for a stock is as follows: 1. % Return: (Dividends + Capital Gains) / Purchase Price - 1 2. Returns are created in two ways: the investment creates income or the investment gains (or loses) value. To calculate the annual rate of return for an. Expected return is calculated by multiplying potential outcomes (returns) by the chances of each outcome occurring, and then calculating the sum of those. What is a Rate of Return? · (($15 + $1 – $10) / $10) x = 60% · 10 shares x ($1 annual dividend x 2) = $20 in dividends from 10 shares · 10 shares x $25 = $ The expected move of a stock for a binary event can be found by calculating 85% of the value of the front month at the money (ATM) straddle. Calculating Expected Portfolio Returns. A portfolio's expected return is the sum of the weighted average of each asset's expected return. LEARNING. This formula states that the expected return on a stock equals the risk-free rate plus the stocks beta times the return on the market minus the risk-free rate. The standard deviation of returns is calculated using the formula for standard deviation. In the formula, the data points are equal to the historical data. The Expected Return Calculator calculates the Expected Return, Variance, Standard Deviation, Covariance, and Correlation Coefficient for a probability.

This expected return for a stock is also known as the market capitalization rate or discount rate. We're going to use all three terms interchangeably throughout. The dividend-discount model can be used for stocks that pay out high dividends and have a steady growth. In this model, you get the stock's value by dividing. Variance is calculated by calculating an expected return and summing a weighted average of the squared deviations from the mean return. TERMS. standard. If the returns you enter are “realized returns”, the calculator gives you the realized return of the portfolio. If they are “expected returns“, you'll get the. The Expected Return is a weighted-average outcome used by portfolio managers and investors to calculate the value of an individual stock, or an entire stock. From a quantitative standpoint, expected returns can be calculated using historical data, taking into account the weights of individual assets within the. The formula for the total stock return is the appreciation in the price plus any dividends paid, divided by the original price of the stock. You simply take the predicted dividend for the next year (DPS1), based on the growth rate of the dividend over time, and divided by your minimum rate of return. It pays a fixed interest rate for a specified amount of time, giving an easy-to-determine rate of return and investment length. Normally, the longer that money. The formula for the total stock return is the appreciation in the price plus any dividends paid, divided by the original price of the stock. CAPM Example – Calculation of Expected Return · Expected return = Risk Free Rate + [Beta x Market Return Premium] · Expected return = % + [ x %]. Expected return formula This means that E[R] is a probability-weighted average of all possible return outcomes where pi is the probability of the ith state. The Expected Return Stock Calculator is designed to help you determine the expected profit based on multiple scenarios for the final stock price. The formula for calculating rate of return is R = [(Ve Vb) / Vb] x , where Ve is the end of period value and Vb is the beginning of period value. It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these results. Expected returns calculations are a key. The standard deviation of returns is calculated using the formula for standard deviation. In the formula, the data points are equal to the historical data. How can I calculate returns on my stock investment using the stock return calculator? Use NerdWallet's free investment calculator to estimate how much your money may grow over time when invested in stocks, mutual funds or other assets. Expected return can be calculated using the formula: E [ r ] = ∑ (r i ∗ p i) where r i represents the possible return and p i the probability of such return. This gives you a total return of % over two years. Finally, if you want to know what your annualized total return was, you need to use the formula from the.

Etn Stock Forecast

Eaton Corporation PLC ETN:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/24/24 · 52 Week Low. The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks. Find the latest Eaton Corporation plc (ETN) stock quote Eaton Corporation plc's (NYSE:ETN) Intrinsic Value Is Potentially 23% Below Its Share Price. Eaton is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. View Eton Pharmaceuticals, Inc. ETON stock quote prices, financial information, real-time forecasts, and company news from CNN. ETN | Complete Eaton Corp. PLC stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ ETN will report FY earnings on 01/30/ Yearly Estimates. On average, Wall Street analysts predict that Eaton's share price could reach $ by Sep 9, The average Eaton stock price prediction forecasts a. What is the Eaton Plc stock forecast? The Eaton Plc stock forecast for tomorrow is $ , which would represent a % loss compared to the current price. Eaton Corporation PLC ETN:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/24/24 · 52 Week Low. The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks. Find the latest Eaton Corporation plc (ETN) stock quote Eaton Corporation plc's (NYSE:ETN) Intrinsic Value Is Potentially 23% Below Its Share Price. Eaton is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. View Eton Pharmaceuticals, Inc. ETON stock quote prices, financial information, real-time forecasts, and company news from CNN. ETN | Complete Eaton Corp. PLC stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ ETN will report FY earnings on 01/30/ Yearly Estimates. On average, Wall Street analysts predict that Eaton's share price could reach $ by Sep 9, The average Eaton stock price prediction forecasts a. What is the Eaton Plc stock forecast? The Eaton Plc stock forecast for tomorrow is $ , which would represent a % loss compared to the current price.

Stock Price Targets. High, $ Median, $ Low, $ Average, $ Current Price, $ Yearly Numbers. Estimates. ETN will report ETN Signals & Forecast. The Eaton Corporation PLC stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. Bid Price and Ask Price. The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is. Find the latest Eaton Corporation PLC (ETN) stock forecast, month price target, predictions and analyst recommendations. The 16 analysts with month price forecasts for Eaton Corporation stock have an average target of , with a low estimate of and a high estimate of. Analyst Eaton Corp plc stock forecast, for symbol ETN forward target price, presented by The Online Investor. What is the forecast, or price target, for Eaton Corp (ETN) stock? A. Eaton Corp has a consensus price target of $ Q. What is the. According to 17 analysts, the average rating for ETN stock is "Buy." The month stock price forecast is $, which is an increase of % from the latest. Eaton (ETN) stock price prediction is USD. The Eaton stock forecast is USD for September 14, Sunday; and USD. Research Eaton's (NYSE:ETN) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Eaton should target then Daily Chart, the stock is trading upwards with tendency to hit the Resistance R3. After crossing at around , the target will. ETN is currently trading in the % percentile range relative to its historical Stock Score levels. Will Eaton Corp PLC Stock Go Up Next Year? Over the next. - ETN Stock was down % · Today, ETN experienced a strong bearish movement, possibly influenced by the broader market trend and specific updates. While ratings are subjective and will change, the latest Eaton Corp (ETN) rating was a maintained with a price target of $ to $ The current price. Get Eaton Corporation PLC (ETN:NYSE) real-time stock quotes, news, price and financial information from CNBC. ETN's current price target is $ Learn why top analysts are making this stock forecast for Eaton at MarketBeat. The intrinsic value of one ETN stock under the Base Case scenario is USD. Compared to the current market price of USD, Eaton Corporation PLC is. Based on our forecasts, a long-term increase is expected, the "ETN" stock price prognosis for is USD. With a 5-year investment, the revenue. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ ETN will report FY earnings on 01/30/ Yearly Estimates. The forecasts range from a low of $ to a high of $ A stock's price target is the price at which analysts consider it fairly valued with respect.

Solar Panel Lease Price

A solar lease is a financing option for residential solar panels where the homeowner leases panels from a solar company. On average, leases last 20 to 25 years with monthly payments ranging from $50 to $, and utility bill savings are generally 10% to 30%. When the lease ends. The lease price is /m. They said there is no escalation cost for 25 years and /m is a fixed cost. The buying price for solar is 28, Solar PPAs may save you just a little bit more money than a lease, but it depends on the specific terms in the contracts. Benefits. No upfront cost: You don't. Lastly, $28, for a kW system is an astronomically high price. Solar should cost about $3 per watt before any incentives (go check r/. The Solar Panel lease Cost A year lease is $$ per month. This means that you'll spend between $12, and $18, each year. Solar panels are. Costs of Leasing Solar Panels: The average cost to lease solar panels ranges between $$ per month. While some companies require a down payment, many. The seller can buyout the lease prior to selling the home but the buyout price is normally more than it should have been to originally purchase the system. Lease option will be /month for 25 years for 12 panels. Be aware of the cost and time required to remove and reinstall Tesla Solar Panels. A solar lease is a financing option for residential solar panels where the homeowner leases panels from a solar company. On average, leases last 20 to 25 years with monthly payments ranging from $50 to $, and utility bill savings are generally 10% to 30%. When the lease ends. The lease price is /m. They said there is no escalation cost for 25 years and /m is a fixed cost. The buying price for solar is 28, Solar PPAs may save you just a little bit more money than a lease, but it depends on the specific terms in the contracts. Benefits. No upfront cost: You don't. Lastly, $28, for a kW system is an astronomically high price. Solar should cost about $3 per watt before any incentives (go check r/. The Solar Panel lease Cost A year lease is $$ per month. This means that you'll spend between $12, and $18, each year. Solar panels are. Costs of Leasing Solar Panels: The average cost to lease solar panels ranges between $$ per month. While some companies require a down payment, many. The seller can buyout the lease prior to selling the home but the buyout price is normally more than it should have been to originally purchase the system. Lease option will be /month for 25 years for 12 panels. Be aware of the cost and time required to remove and reinstall Tesla Solar Panels.

The monthly lease payment for solar energy typically ranges from $50 to $ Even with interest on the solar energy loan, the total cost will. The average cost for a 5kWh solar power system in Chuluota, Florida is $ per watt, compared to the state's average electricity rate of $ per kWh. One source puts the average cost of leasing solar panels in the U.S. at $$ per month. You'll want to price check with several companies before you sign a. But in just the last 12 years, the cost of an average solar system has cut in half, from $40, to $20,, according to the Solar Energy Industries. How Much Is a Solar Lease per Month in Florida? · Monthly Cost. The average cost for a 5kWh solar power system in Chuluota, Florida is $ per watt, compared. Solar Panel Lease Cost A year lease will cost $$ per month. This means that you'll be paying between $12, and $18, each year. Your solar panel. Leasing Solar in California As you can see, the savings add up much more slowly with a leased solar panel system. But since you do not have to pay any money. This guide explains the true cost of leasing solar panels by comparing it to buying to help you determine if leasing is right for your specific situation and. What Is The Cost Difference Between Leasing Solar Panels And Buying Them? Though leasing is a great financing option for solar panels, buying them outright. A solar lease allows you to enjoy the benefits of solar power without the upfront costs of purchasing and installing a system. With our year leasing program. Key takeaways · A solar lease is a type of financing option that requires $0 upfront, and instead homeowners pay monthly lease payments to use the solar panels. A solar lease agreement is a hands-off, manageable way for homeowners to get solar panels. Essentially, a you lend a solar service provider your roof, and they. The upfront price for an average-sized residential solar system has fallen from $40, in to about $25, today. Meanwhile, utility-scale solar now costs. Are you on a ppa or a lease? If ppa, what's your price for kWh for the ppa? How did you find the “price” of a new system? Did you get a contract. A solar lease is a long-term contract between a customer and a solar panel provider. For homeowners seeking to fulfill their energy needs without high utility. Leasing solar panels for your home is not a good idea from a financial perspective. We simply do not recommend it. We provide the opportunity to purchase, finance or lease your solar panels. The price of solar energy from Pineapple is usually lower than the cost customers. Prior research by the college of Agricultural Studies at Penn State University has suggested that year solar land lease rates were $ to $1, per acre in. A solar panel lease costs $ per month on average, with most spending between $50 and $ per month depending on their location and energy needs. Leasing. What is a solar lease? Solar panel leasing presents an alternative avenue for harnessing solar energy without the burden of upfront costs. This arrangement.

1 2 3 4 5